TOKYO, April 11, 2023 – 3DOM Alliance Inc. (“3DOM Alliance”) and its subsidiary, decarbonization solution provider noco-noco Pte. Ltd. (“noco-noco”), have entered into a Memorandum of Understanding (“MOU”) with Assemblepoint Co., Ltd. (“Assemblepoint”), a Japanese EV manufacturer that makes and sells “Smart BUS” electric minibuses, for a business alliance to promote the decarbonization of transportation in the Philippines.

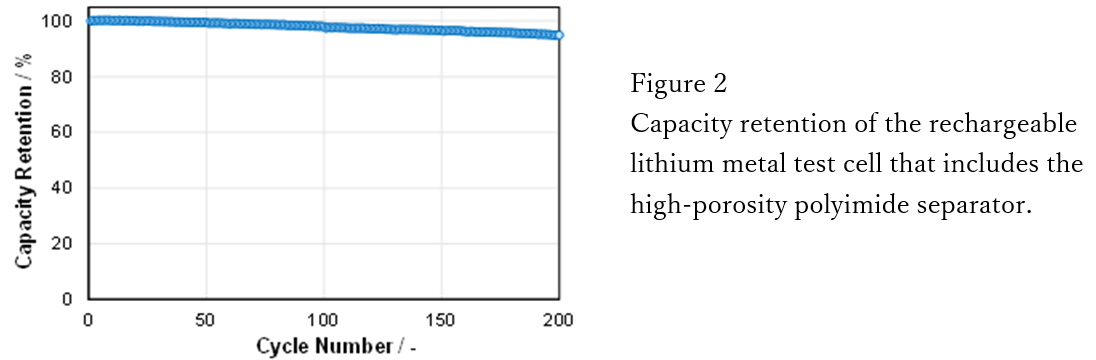

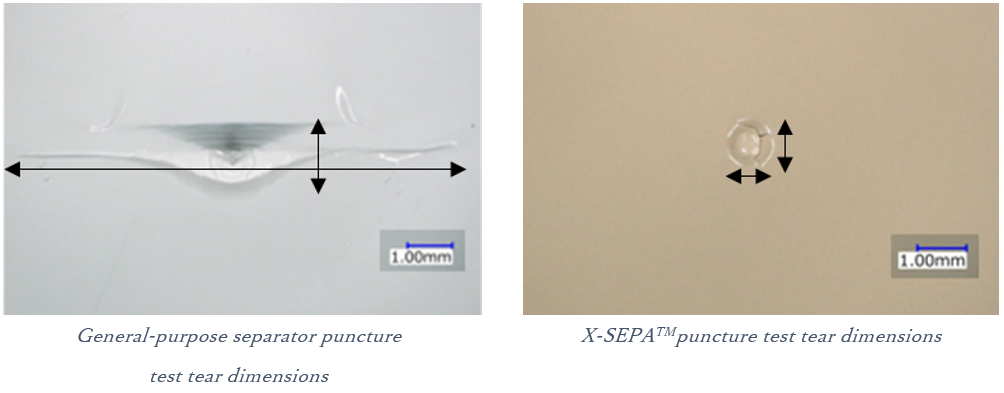

Anthropogenic greenhouse gas emissions continue to amplify climate change around the world, and the Philippines faces particularly severe air pollution due, in part, to a heavy-emissions transport sector. The alliance aims to offer a clean alternative by jointly developing a new EV model that incorporates Assemblepoint’s EV development technology and the proprietary X-SEPA™ separator technology developed by 3DOM Alliance, first targeting 15,000 vehicles. Per the MOU, 3DOM Alliance and noco-noco will engage with Assemblepoint in joint vehicle development and joint battery development and manufacturing, as well as provide battery services and carbon neutral leasing.

Through noco-noco’s fleet decarbonization solution, the “Smart BUS” electric minibus bodies are to be provided to fleet operators on a lease basis and batteries provided through a circular subscription model, eliminating the need for upfront investment in those assets by fleet operators. The service will be made progressively carbon neutral by offsetting carbon emissions from vehicle and battery manufacturing with carbon credits and using renewable energy for battery charging. Amid increasing pressure for decarbonization in the transportation industry, the alliance seeks to alleviate financial and practical challenges associated with vehicle and battery procurement and ownership and offer an accessible path to carbon neutrality for fleet operators.

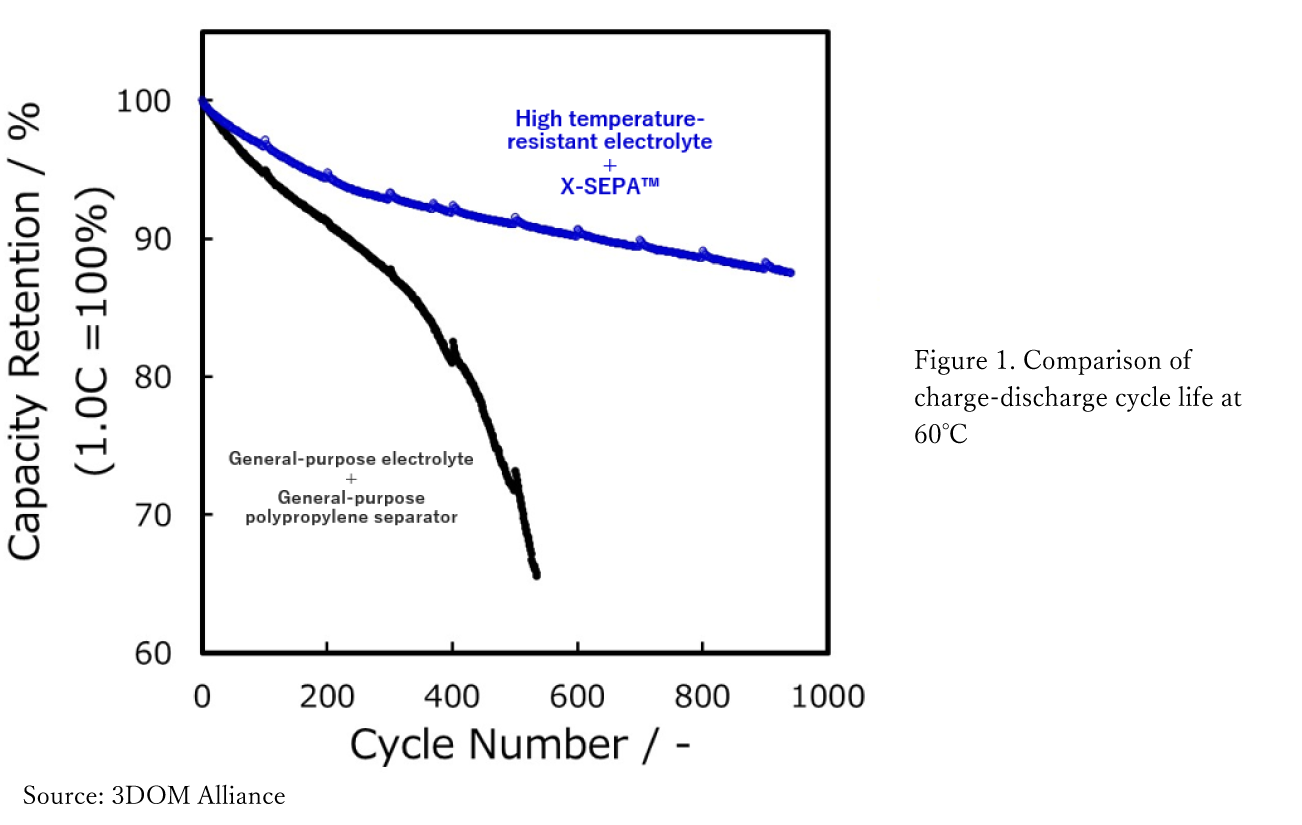

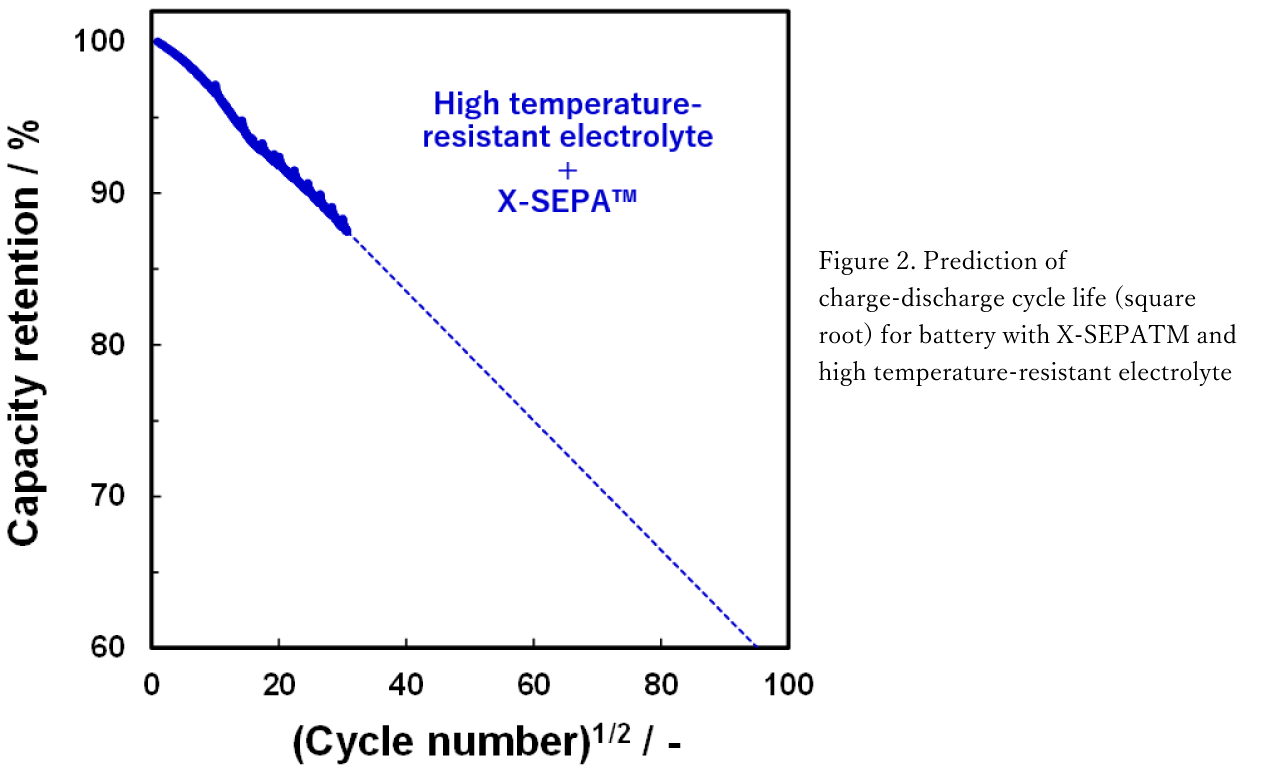

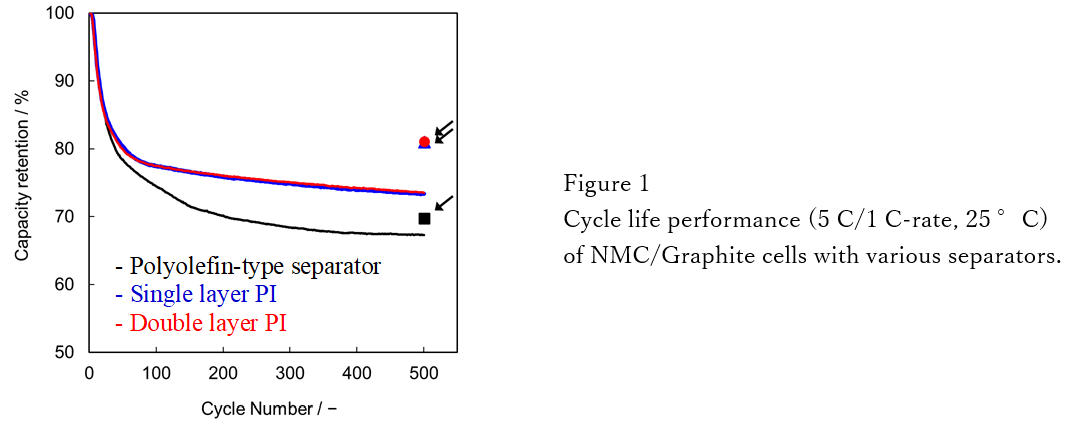

The service will leverage the advantages of the X-SEPA™, designed to enhance lifespan, reliability, and heat resistance, to provide vehicles with batteries that are more sustainable and uniquely suited to the hot local environment. Following long-life batteries’ use in the “Smart BUS” electric minibuses, the circular battery services may further encompass opportunities for second-life use to maximize their impact.

Masataka Matsumura, Representative Director of 3DOM Alliance and CEO of noco-noco, comments, “This alliance with Assemblepoint is a testimony to our shared ambition of delivering change in the decarbonization of the transport sector everywhere. Our proprietary X-SEPA™ technology and business model are designed to deliver sustainability, affordability, and convenience, and we’re excited to embark on this collaboration in the Philippines.”

By providing cutting-edge clean technologies through a circular model that lowers barriers to their adoption, 3DOM Alliance, noco-noco, and Assemblepoint endeavor to accelerate electrification in the Philippines and drive a no-CO2 future.

About 3DOM Alliance Inc.

Established in Japan in 2014, 3DOM Alliance Inc. strives to solve environmental problems through the research and development of cutting-edge technologies and business models that promote decarbonization and ecological conservation.

About noco-noco Pte. Ltd.

noco-noco Pte. Ltd. is a decarbonization solutions provider working to accelerate the global transformation to a carbon-neutral economy and an affiliated entity to 3DOM Alliance. Through use of the X-SEPA™, a proprietary multilayer battery separator, and by providing sustainable mobility services and an innovative energy management platform, noco-noco addresses the need for clean, affordable, and sustainable energy solutions.

About Assemblepoint Co., Ltd.

Assemblepoint Co., Ltd. is an EV manufacturer that makes and sells electric minibuses and minivans under its Japanese brand in the Philippines. Assemblepoint completed its prototype in 2018, and as of 2023, has already delivered vehicles to public buses operators, logistics companies, etc., and has products running on public roads. Assemblepoint is developing business with a focus on the ASEAN region, where the shift to EVs is rapidly advancing.

Important Information and Where to Find It

On December 29, 2022, Prime Number Holding Limited, an exempted company limited by shares incorporated under the laws of the Cayman Islands (“PubCo”), Prime Number Acquisition I Corp. (“PNAC”), Prime Number Merger Sub Inc., a Delaware corporation and a direct wholly-owned subsidiary of PubCo, Prime Number New Sub Pte. Ltd., a Singapore private company limited by shares and a direct wholly-owned subsidiary of PubCo, noco-noco, and certain shareholders of noco-noco collectively holding a controlling interest, entered into a business combination agreement, pursuant to which PNAC is proposing to enter into a business combination with noco-noco involving a merger and a share exchange. This press release does not contain all the information that should be considered concerning the proposed business combination and is not intended to form the basis of any investment decision or any other decision in respect of the business combination. PNAC’s stockholders and other interested persons are advised to read, when available, the proxy statement/prospectus and the amendments thereto and other documents filed in connection with the proposed business combination, as these materials will contain important information about noco-noco, PNAC and the proposed business combination. When available, the proxy statement/prospectus and other relevant materials for the proposed business combination will be mailed to stockholders of PNAC as of a record date to be established for voting on the proposed business combination. Such stockholders will also be able to obtain copies of the proxy statement/prospectus and other documents filed with the Securities and Exchange Commission (the “SEC”), without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to PNAC at its principal executive offices at c/o 1129 Northern Blvd, Suite 404, Manhasset, NY 11030, United States.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of section 27A of the U.S. Securities Act of 1933, as amended (the “Securities Act”), and section 21E of the U.S. Securities Exchange Act of 1934 (“Exchange Act”) that are based on beliefs and assumptions and on information currently available to noco-noco and PNAC. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing,” “target,” “seek” or the negative or plural of these words, or other similar expressions that are predictions or indicate future events or prospects, although not all forward-looking statements contain these words. Any statements that refer to expectations, projections or other characterizations of future events or circumstances, including the proposed business combination, the benefits and synergies of the proposed business combination, the markets in which noco-noco operates as well as any information concerning possible or assumed future results of operations of the combined company after the consummation of the proposed business combination, are also forward-looking statements. These statements involve risks, uncertainties and other factors that may cause actual results, levels of activity, performance or achievements to be materially different from those expressed or implied by these forward-looking statements. Although each of noco-noco and PNAC believes that it has a reasonable basis for each forward-looking statement contained in this communication, each of noco-noco and PNAC caution you that these statements are based on a combination of facts and factors currently known and projections of the future, which are inherently uncertain. Neither noco-noco nor PNAC can assure you that the forward-looking statements in this communication will prove to be accurate. These forward-looking statements are subject to a number of risks and uncertainties, including, among others, the ability to complete the business combination due to the failure to obtain approval from PNAC’s stockholders or satisfy other closing conditions in the business combination agreement, the occurrence of any event that could give rise to the termination of the business combination agreement, the ability to recognize the anticipated benefits of the business combination, the amount of redemption requests made by PNAC’s public stockholders, costs related to the transaction, the impact of the global COVID-19 pandemic, the risk that the transaction disrupts current plans and operations as a result of the announcement and consummation of the transaction, the outcome of any potential litigation, government or regulatory proceedings and other risks and uncertainties. There may be additional risks that neither noco-noco nor PNAC presently know or that noco-noco and PNAC currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by noco-noco, PNAC, and their respective directors, officers or employees or any other person that noco-noco and PNAC will achieve their objectives and plans in any specified time frame, or at all. The forward-looking statements in this press release represent the views of noco-noco and PNAC as of the date of this communication. Subsequent events and developments may cause those views to change. However, while noco-noco and PNAC may update these forward-looking statements in the future, there is no current intention to do so, except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing the views of noco-noco or PNAC as of any date subsequent to the date of this communication.

No Offer or Solicitation

This press release is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the potential transaction and does not constitute an offer to sell or a solicitation of an offer to buy any securities of noco-noco or PNAC, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act.

Participants in the Solicitation

noco-noco, PNAC, and their respective directors, executive officers, other members of management, and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies of PNAC’s stockholders in connection with the proposed transaction. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of PNAC’s stockholders in connection with the proposed business combination will be set forth in the proxy statement/prospectus on Form F-4 to be filed with the SEC.